Increasing Your Tax Performance Via Specialist Suggestions From A Financial Therapist

Content Produce By-Newell Steele

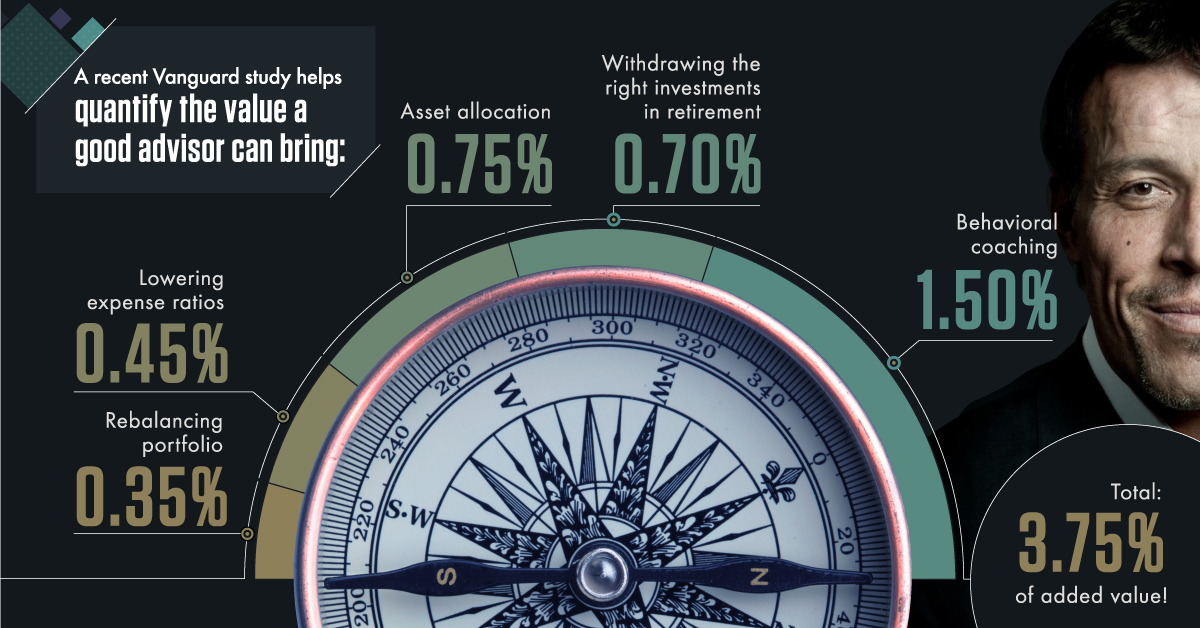

When it concerns optimizing your tax obligation savings, the assistance of a financial consultant can be a game-changer. Visualize the possibilities of optimizing your economic situation, but it's not practically conserving cash-- it's about safeguarding your financial future. By partnering with a professional, you can unlock tailored techniques that exceed the surface-level deductions. Remain tuned to uncover just how these understandings can improve your approach to taxes and elevate your financial standing.

The Advantages of Tax Obligation Planning

Optimizing your tax obligation cost savings via calculated preparation can substantially impact your economic health. By proactively managing your tax obligations, you can make sure that you aren't paying greater than necessary which you're taking advantage of all offered reductions and credit scores. Tax preparation enables you to structure your financial resources in a manner that reduces your tax obligation liability while staying certified with the law.

One key advantage of tax obligation planning is the capability to enhance your financial investments. By strategically intending your investments, you can capitalize on tax-efficient techniques that help you maintain even more of your returns. Additionally, tax planning can assist you prepare for significant life events, such as purchasing a home or starting a service, in a tax-efficient manner.

Additionally, tax planning can aid you navigate intricate tax obligation laws and policies, ensuring that you remain in compliance and preventing pricey charges. By collaborating with a financial advisor that focuses on tax planning, you can establish a tailored strategy that lines up with your financial objectives and maximizes your tax obligation savings.

Strategies for Making Best Use Of Reductions

To optimize your deductions efficiently, consider implementing tactical tax preparation methods. https://rasheeda-shenna21ronnie.blogbright.net/in-search-of-a-reputable-monetary-expert-explore-the-essential-attributes-to-discover-in-a-consultant-who-will-contribute-in-shaping-your-financial-future is to maintain comprehensive documents of all your costs throughout the year. This includes invoices for charitable donations, clinical costs, business expenses, and any other deductible prices. By maintaining organized documents, you can quickly determine potential reductions when it comes time to file your taxes.

Additionally, benefiting from tax-advantaged accounts such as Health and wellness Cost Savings Accounts (HSAs) or Flexible Investing Accounts (FSAs) can help you optimize your deductions. Contributions to these accounts are usually tax-deductible, giving you with an immediate tax benefit while additionally helping you save for future healthcare costs.

Another means to maximize reductions is to pack your costs in such a way that allows you to detail reductions in specific years. By strategically timing your repayments, you can possibly surpass the common deduction and enhance your tax obligation financial savings. Make sure to consult with an economic expert to determine the very best packing technique for your specific economic scenario.

Investing Carefully for Tax Financial Savings

Consider expanding your investment profile tactically to maximize tax obligation financial savings. By spreading your financial investments throughout various property classes, such as stocks, bonds, realty, and retirement accounts, you can take advantage of numerous tax benefits. For example, investing in tax-advantaged accounts like 401( k) s or IRAs can aid lower your taxable income while saving for retired life. In addition, local bonds supply tax-free passion earnings at the government level and often at the state degree, supplying a possibility to gain tax-efficient returns.

One more way to spend carefully for tax obligation financial savings is to exercise tax-loss harvesting. https://www.businessupnorth.co.uk/pareto-financial-planning-appoints-suzanne-chadwick-as-head-of-training-and-development/ entails marketing investments that have actually experienced a loss to offset gains in various other financial investments, therefore lowering your total tax obligation obligation. By being tactical concerning when you deal investments, you can lessen capital gains tax obligations and potentially boost your after-tax returns.

In addition, think about utilizing tax-efficient investment lorries like exchange-traded funds (ETFs) or index funds, which generally have reduced turnover and can result in less capital gains circulations, minimizing your tax obligation problem. By meticulously selecting financial investments and bearing in mind the tax effects, you can properly grow your wealth while minimizing the tax obligations you owe.

Final thought

Finally, working with an economic consultant to optimize your tax financial savings is a smart investment in your monetary future.

By executing tailored tax preparation methods, leveraging deductions, and making wise financial investment decisions, you can properly lower your tax responsibility and maintain more cash in your pocket.

Relying on the competence of an economic consultant can help you navigate the complexities of the tax obligation system and achieve your monetary objectives.